360-Degree Customer Profiles

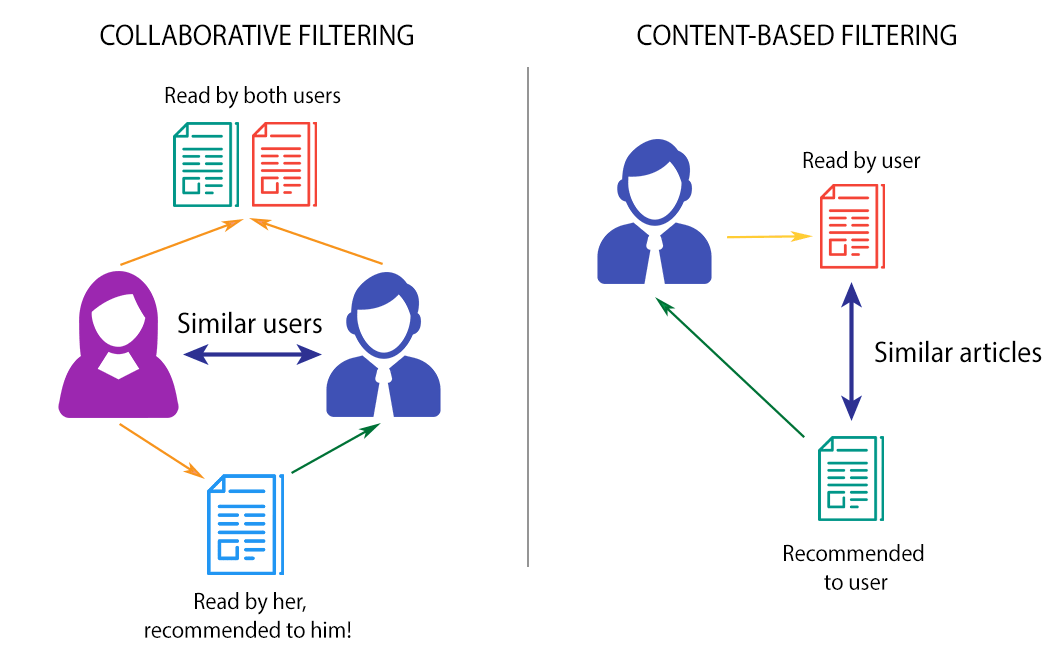

Everyone aims to improve customer satisfaction, and they employ big data to accomplish that. The more you know about your customers,

the easier to keep them happy – and keep them paying.

Companies are combining all their direct customer connections – email, call center, adjuster reports, etc. – with indirect sources – social media, blog comments, website and clickstream data

to create a 360-degree profile of each individual.

At DataCave, we help our client to collect the data into customer service groups that gives employees a consolidated view of each customer.

With a 360-degree profile in hand, employees have the means to refine their approach to sales, marketing and existing customer service.

Call Center Optimization

A call center is golden cow for data opportunity and big data for the companies. At DataCave we are investigating ways to:

-

Combine telecom data to analyze call center activities and refine training guidelines.

- Analyze raw telecom data, model temporal call patterns, and create a plan for staffing optimization.

- Use sentiment analysis – e.g., text analytics on social media – to improve customer service.

Call-center agents should be in an ideal situation to sell customers additional products and offer you the most relevant product for the customer particular needs.

Insurance Sector

Many elements of the insurance business could be transformed, such as distribution, risk selection, pricing and claims management.

The insurance industry's core functions historically used large volumes of data to assess and price risk and predict future claims.

Expansion in computer processing capabilities, data storage capacity, the proliferation of internet use and the development of "smart" devices have created new opportunities

for insurers to access and process information

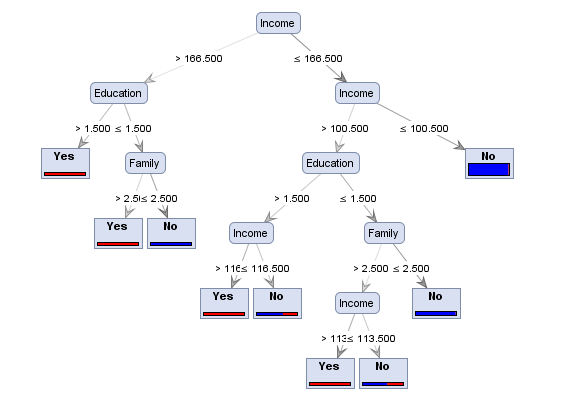

Risk Pricing

We combine insurance data with analytical applications – e.g., behavioral models based on customer profile data – with a continuous stream of real-time data

– e.g., hospital data, traffic data, policy department claims data,driver data,GPS data, weather reports, vehicle sensors – to create detailed and personalized assessments of risk.

.If risk-based capital can be calculated more accurately,

this influences the minimum amount of premium that needs to be held.”Life and Health Insurance

We live in a monitored world. Life and health insurance companies know this more than anybody. To create profiles of customer health and develop individual "well-being" scores, insurers are now casting the information net very wide indeed. By collecting hospital with customer’s claims datasets we can detect potential risks. For instance, using claims data to discover which customers are most at risk of ending up

in the hospital with preventable claims or discovering unreported chronic behavior.

This gives insurance companies the means to intervene before the event occurs.

Banking Sector

We look at the general account usage per month per year over the time series. We analyze the net transaction value for account,

and proceed to inspect the trends in credit patterns and debit patterns. We also observe that for some accounts, the money transaction volume has increased, while for others

it has remained fairly consistent. There are some accounts in for which the net debit exceeded net credit in the system.

As a result we will break this up and analyze to engineer the following :

×

There is a gradual increase in net spending per account per month per year.

There is a possible cyclicality and/or seasonality in the spending patterns. This can be dependent on a lot of factors,

like

- macro-economic conditions

- festive seasons

- income sources of the entities under observation of spending habits of the entities under observation

Consumer Behavior Analysis based on channel usage analysis transactions can occur via many modes and channels, like ATM, online transactions and creidt card transactions.

The nature of transaction is also considered an important parameter for understanding the needs, and habits of a customer.

There has been a gradual increase in net money flowing into accounts

This goes in sync with the way monetary assets increase in general.

If there is noticeable increase in money being credited on monthly basis.

The fluctuations in the credit may be due to a variable component in the salary; however, the basic salary would have increased in this case.

- Identification of stable regular salaried account can further benefit to the banks as these clients can then be approached with better savings and liability products and schemes.

- Identification of non-salaried account increase (could be contractual employees, or have staggered sources of income. ) can help bank create and deliver products such as small savings plan and fixed deposit plans with attractive returns.

Maximum debit and maximum credit patterns for the account

The net credit into the account increases, which improves the spending capacity;

and, as the spending capacity increases, the debit activity also increases.

Based on consumer behavior analysis, we can infer the following:

- This person has a capacity to spend, and though infrequently, he has spent more than what is credited to his account during certain periods. Therefore this person is ideal candidate for potential loan applicant.

- This person also shows that as his capacity to spend increases, the net debit also increases. Hence this person is also ideal candidate for using credit card.

He can be offered a credit card or his credit limit can be increased if he is already using one.

- Credit card linked offers can be extended to this person since he is more likely to use his card